REFERENCE: Ref.03_07

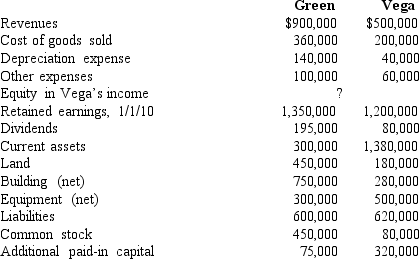

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010 consolidated retained earnings.

Definitions:

Society

A group of individuals involving persistent social interactions, or a large social grouping sharing the same geographical or social territory.

Genetic Pollution

The uncontrolled spread of genetic material beyond its intended area, particularly the introduction of genetically modified organisms (GMOs) into the wild, potentially causing harm to native species and biodiversity.

Splicing Genes

A genetic engineering technique that involves cutting and joining fragments of DNA from different sources to incorporate new traits into an organism.

Health Dangers

Risks or threats to physical and mental well-being that can cause harm or disease.

Q1: In a pooling of interests,<br>A)revenues and expenses

Q21: Explain how the treasury stock approach treats

Q41: Safire Corp.recently acquired $500,000 of the bonds

Q43: Compute the amount of consolidated buildings (net)at

Q51: Assume that Bullen paid a total of

Q61: The trustor is the<br>A)income beneficiary of the

Q62: Yoderly Co. ,a wholly owned subsidiary of

Q92: The accrual-based income of Beagle Co.is calculated

Q103: Compute Cody's undistributed earnings for 2009.<br>A)$62,500.<br>B)$125,000.<br>C)$87,500.<br>D)$100,000.<br>E)$70,000.

Q112: If this combination is viewed as an