REFERENCE: Ref.03_07

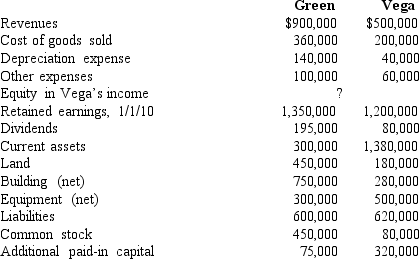

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010 consolidated retained earnings.

Definitions:

Biological Theories

Concepts that explain phenomena or behavior strictly in terms of biological processes and heredity.

John Watson

An American psychologist and one of the founders of behaviorism, known for his theory that human behavior can be studied and modified through conditioning.

Hypnosis

A trance-like state of focused attention, reduced peripheral awareness, and an enhanced capacity to respond to suggestion, used for therapeutic purposes.

Symptoms Of Hysteria

Manifestations typically associated with an outdated diagnosis, now more likely referred to as conversion disorder, which include uncontrollable emotional outbreaks and disturbances in physical functioning.

Q5: Yules Co.acquired Noel Co.in an acquisition transaction.Yules

Q21: A gift that is specified in a

Q25: What amount should have been reported for

Q28: Net cash flow from operating activities was:<br>A)$92,000.<br>B)$27,000.<br>C)$63,000.<br>D)$29,000.<br>E)$33,000.

Q32: C Co.currently owns 80% of D Co.and

Q46: Compute consolidated buildings (net)at the date of

Q61: What is the new percent ownership of

Q62: Assume Riley issues 70,000 shares instead of

Q66: What is the purpose of the adjustments

Q67: During the current year,an estate generates the