REFERENCE: Ref.03_01 On January 1,2009,Cale Corp.paid $1,020,000 to Acquire Kaltop Co.Kaltop Maintained

REFERENCE: Ref.03_01

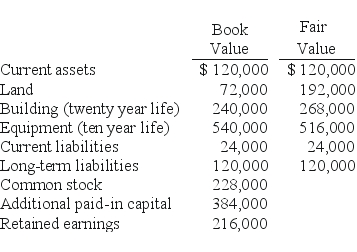

On January 1,2009,Cale Corp.paid $1,020,000 to acquire Kaltop Co.Kaltop maintained separate incorporation.Cale used the equity method to account for the investment.The following information is available for Kaltop's assets,liabilities,and stockholders' equity accounts:

SHAPE \* MERGEFORMAT

Kaltop earned net income for 2009 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2009 of $126,000 and paid dividends of $48,000 during the year.

-In Cale's accounting records,what amount would appear on December 31,2009 for equity in subsidiary earnings?

Definitions:

Operating Agreement

A contract among members of a Limited Liability Company (LLC) outlining the business's financial and functional decisions, including rules, regulations, and provisions.

Incorporators

The people who actually sign the articles of incorporation to start a corporation.

Permission to Incorporate

Official authorization or approval granted to establish a corporation or legal entity.

Corporate Capitalist State

A socioeconomic system where corporate entities and economic elites have significant influence over state policies and governance, often leading to a fusion of corporate and state power.

Q7: What is the noncontrolling interest in Sigma's

Q23: Which of the following is not a

Q29: If a subsidiary reacquires its outstanding shares

Q29: On the consolidated financial statements,what amount should

Q46: How much difference would there have been

Q68: Johnson,Inc.owns control over Kaspar,Inc.Johnson reports sales of

Q78: How would consolidated earnings per share be

Q82: Which of the following is reported for

Q113: Which of the following is not true

Q115: From which methods can a parent choose