REFERENCE: Ref.03_07

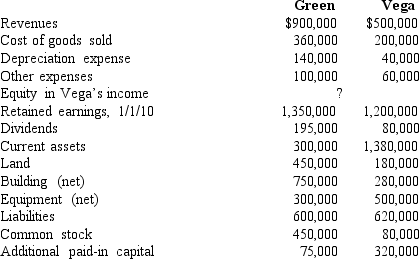

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the equity in Vega's income reported by Green for 2010.

Definitions:

Minimum Required Rate of Return

The lowest rate of return that a potential investment must offer to be considered acceptable, taking into account the investor's cost of capital and risk appetite.

Annual Turnover

The total sales or revenue a company generates in one year.

ROI Analysis

A financial metric used to evaluate the efficiency of an investment or compare the efficiency of several different investments, calculated by dividing the net profit from the investment by the initial cost of the investment.

Net Operating Income

The income generated from normal business operations, calculated as revenues minus operating expenses and excluding income from investments and taxes.

Q4: A testamentary trust is a trust<br>A)intended to

Q14: Compute the noncontrolling interest in the net

Q18: Assuming the combination is accounted for as

Q36: How would you account for in-process research

Q41: Safire Corp.recently acquired $500,000 of the bonds

Q73: If Watkins pays $400,000 in cash for

Q77: Keenan Company has had bonds payable of

Q81: What is Beta's accrual-based income for 2009?<br>A)$200,000.<br>B)$276,800.<br>C)$280,000.<br>D)$296,000.<br>E)$300,000.

Q82: Required:<br>Prepare a schedule to show consolidated net

Q114: On January 1,2009,Cocker reacquired 8,000 of the