REFERENCE: Ref.03_14

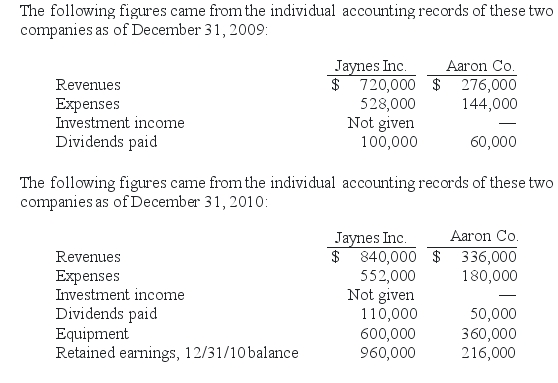

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated net income for the year ended December 31,2010?

Definitions:

Operating Cash Flow

A financial metric that indicates the amount of money generated by a company's business operations after accounting for operating expenses.

Net Working Capital

A measure of a company's short-term financial health and liquidity, calculated as current assets minus current liabilities.

Profit Margin

A financial metric expressing the ratio of a company's net income to its sales, demonstrating the percentage of revenue that exceeds the cost of goods sold.

Equivalent Annual Cost

A financial analysis approach to compare the cost-effectiveness of different assets with differing lifespans by calculating their annual costs.

Q1: The city operates a public pool where

Q6: Assume Riley issues 70,000 shares instead of

Q10: Which of the following will be included

Q14: Dutch Co.has loaned $90,000 to its subsidiary,Hans

Q23: How are intercompany inventory transfers reflected on

Q24: The board of commissioners of the city

Q31: With regard to the intercompany sale,which of

Q75: Compute the December 31,2010,consolidated revenues.<br>A)$1,400,000.<br>B)$800,000.<br>C)$500,000.<br>D)$1,590,375.<br>E)$1,390,375.

Q94: Assuming the combination is accounted for as

Q109: When is a goodwill impairment loss recognized?<br>A)Annually