REFERENCE: Ref.02_05

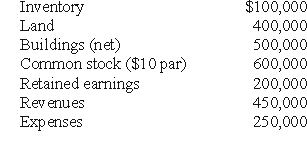

Carnes has the following account balances as of May 1,2000 before a pooling of interests transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On May 1,2000,Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On May 1,2000,Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock.

-Assume Riley issues 70,000 shares instead of 30,000 at date of acquisition.Riley currently has $40,000 of additional paid-in capital on its books.By how much will Riley's retained earnings increase or decrease as a result of the combination?

Definitions:

Product Differentiation

The strategy businesses use to distinguish their products from those of competitors, through variations in quality, features, design, or branding.

Physical Differences

Variations in the tangible characteristics or attributes of a product, which can affect consumer preference and value perception.

Long-run Equilibrium

A state in which all factors of production can be adjusted, and all economic agents have fully adapted to any changes, resulting in a stable economy with no tendency for change.

Economic Profit

The difference between a firm's total revenue and its total costs, including both explicit and implicit costs.

Q8: Prepare the journal entry to record the

Q22: What is meant by the term fiscally

Q40: King Corp.owns 85% of James Co.King uses

Q49: Which of the following types of health

Q54: Which one of the following financial statements

Q55: The advantages of the partnership form of

Q58: Gentry Inc.acquired 100% of Gaspard Farms on

Q74: Compute the income from Gargiulo reported on

Q80: On January 1,2009,Rand Corp.issued shares of its

Q87: Required:<br>Under the treasury stock approach,what is Jull's