REFERENCE: Ref.03_15

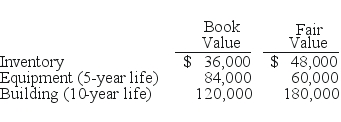

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

-If Utah paid $264,000 in cash for Trimmer,and the original transaction occurred on January 1,2008 under SFAS 141,what allocation should have been assigned to the subsidiary's Building account and its Equipment account in a December 31,2010 consolidation? The fair value of net assets is $288,000.

Definitions:

Unit Fixed Costs

Costs that remain constant for a product regardless of how many units are produced or sold.

Decision Making

The process of making choices by identifying a decision, gathering information, and assessing alternative resolutions.

Incremental Revenue

Additional income generated from selling more units of a product or from launching a new product or service.

Relevant Information

Information that is applicable and crucial to the decision-making process, having the ability to affect the outcome of a decision.

Q3: How much difference would there have been

Q7: A local partnership has assets of cash

Q9: Under modified accrual accounting,revenues should be recognized

Q10: What amount should have been reported for

Q16: What is the difference between an executor

Q59: Which of the following statements is true

Q60: Which of the following statements is true

Q63: The executor of the estate of Yelbert

Q76: Assume that Botkins acquired Volkerson as a

Q116: If Utah paid $264,000 in cash for