REFERENCE: Ref.03_15

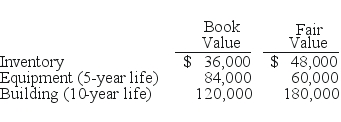

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

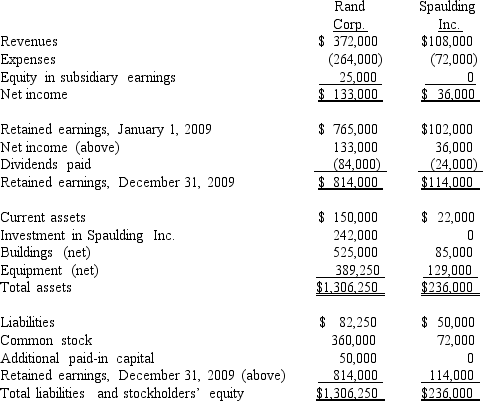

-On January 1,2009,Rand Corp.issued shares of its common stock for all of the outstanding common stock of Spaulding Inc.This combination was accounted for as a purchase.Spaulding's book value was only $140,000 at the time,but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life)were undervalued on Spaulding's records by $60,000 while equipment (five-year life)was undervalued by $25,000.Any excess cost over fair value is assigned to goodwill.

Following are the individual financial records for these two companies for the year ended December 31,2009.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Planning Stage

An initial phase in a project or process where objectives are defined, and strategies are developed to achieve them.

Usability Testing

A method of evaluating a product or system by testing it with real users to gauge how easy and efficient it is to use.

Project Budget

An estimate of the costs, resources, and revenues related to completing a specific project within a defined time frame.

Draft

An initial version of a document or plan that is open to revision, modification, or discussion before finalization.

Q1: Parent Corporation recently acquired some of its

Q11: In consolidation at December 31,2009,what adjustment is

Q25: Proprietary funds are<br>A)Funds used to account for

Q65: Revenue from property taxes should be recorded

Q70: What is the consolidated gain or loss

Q72: Which of the following statements is false

Q78: What accounting method requires a subsidiary to

Q86: The accrual-based income of Maroon Corp.is calculated

Q88: Compute Simon's share of income from Wilson

Q106: What will be reported as the noncontrolling