REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

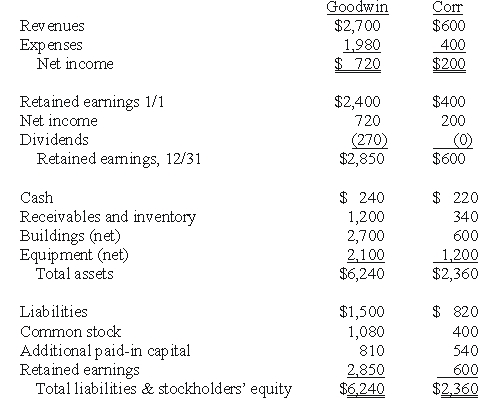

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-If the combination is accounted for as a purchase,at what amount is the investment recorded on Goodwin's books?

Definitions:

Caldera

A large volcanic crater typically formed by a major eruption leading to the collapse of the mouth of the volcano.

Metal-Rich Fluids

Liquids that contain high concentrations of metals, often found in geological settings where they can deposit valuable ore minerals.

Limestone

A sedimentary rock primarily composed of calcium carbonate (CaCO3), often formed from marine organisms' shells.

Investigation Area

A specific location or region that is being systematically studied or examined for a particular purpose.

Q4: Compute Collins' share of Smeder's net income

Q7: A local partnership has assets of cash

Q10: Which statement below is not correct?<br>A)The accounting

Q11: Which of the following statements is true

Q38: What are the benefits or advantages of

Q38: Polar sold a building to Icecap on

Q46: Which of the following statements is required

Q47: Chapel Hill Company had common stock of

Q59: What configuration of corporate ownership is described

Q91: When Ryan's new percent ownership is rounded