REFERENCE: Ref.02_04 on January 1,20X1,the Moody Company Entered into a Transaction for Transaction

REFERENCE: Ref.02_04

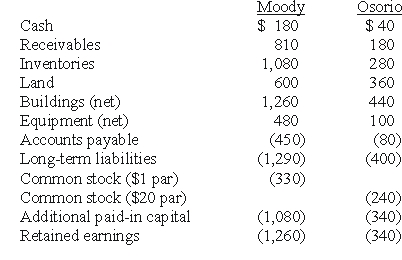

On January 1,20X1,the Moody company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this purchase.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-If the transaction is accounted for as a purchase,what amount was recorded as the investment in Osorio?

Definitions:

CESA Contribution

Funds put into a Coverdell Education Savings Account (CESA) to finance a beneficiary's educational expenses.

AGI

Adjusted Gross Income is the gross income of an individual or entity minus specific deductions, used to calculate taxable income on U.S. federal income taxes.

SIMPLE Plan

A retirement savings plan available for small businesses and self-employed individuals, offering a simplified way to save for retirement.

Salary

A fixed regular payment, typically monthly or biweekly, made by an employer to an employee, especially a professional or white-collar worker.

Q4: A testamentary trust is a trust<br>A)intended to

Q18: The Yelton Center is a voluntary health

Q20: On January 1,2008,Wakefield City purchased $40,000 office

Q37: What term is used by voluntary health

Q56: Which of the following statements is true?<br>A)Delta

Q62: Yoderly Co. ,a wholly owned subsidiary of

Q65: Revenue from property taxes should be recorded

Q73: What is Delta's accrual-based income for 2009?<br>A)$1,091,520.<br>B)$1,115,520.<br>C)$1,168,000.<br>D)$1,168,520.<br>E)$1,200,000.

Q104: Compute the amortization of gain for 2009

Q116: If Utah paid $264,000 in cash for