REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

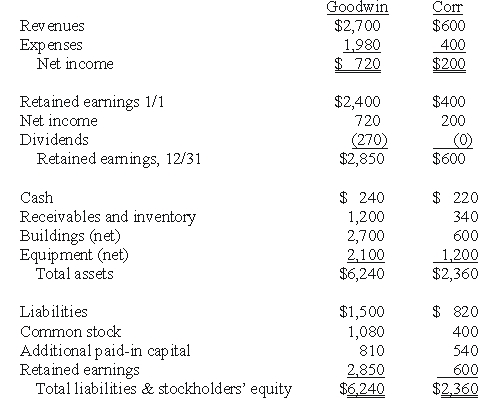

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as an acquisition,compute the consolidated goodwill account at December 31,20X1.

Definitions:

Population Mean

The mean value of every number within a given population.

Population Proportion

The fraction or percentage of a population that displays a particular attribute or characteristic.

Margin of Error

A measure indicating the range of values above and below a sample statistic in a confidence interval.

Point Estimate

A single value derived from sample data that serves as a best guess or best estimate of a population parameter.

Q20: Executor's fees and court costs for settling

Q23: What is consolidated current assets as of

Q25: How much would Lila have received from

Q28: Record the journal entry for the sale

Q52: Which of the following is usually not

Q58: What amount will be reported for consolidated

Q66: One company acquires another company in a

Q74: Compute consolidated expenses at date of acquisition.<br>A)$2,760.<br>B)$3,380.<br>C)$2,770.<br>D)$2,735.<br>E)$2,785.

Q81: What is Beta's accrual-based income for 2009?<br>A)$200,000.<br>B)$276,800.<br>C)$280,000.<br>D)$296,000.<br>E)$300,000.

Q104: Which of the following statements is false