REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

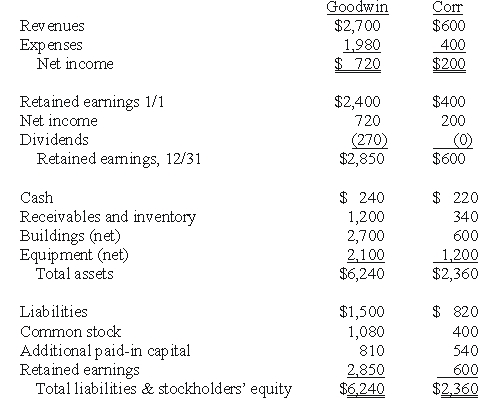

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as an acquisition,compute the consolidated retained earnings at December 31,20X1.

Definitions:

Implicit Lease Rate

The interest rate assumed in the lease contract that equates the present value of the lease payments and any unguaranteed residual value to the fair value of the asset.

Capitalization

The process of recording an expenditure as an asset on the balance sheet, rather than an expense, allowing its cost to be expensed over time.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its short-term assets.

Return On Equity

A measure of a corporation's profitability that calculates how much profit a company generates with the money shareholders have invested.

Q3: What was the balance in Young's Capital

Q24: Compute the amount of consolidated land at

Q49: If Smith's net income is $100,000 in

Q52: T Corp.owns several subsidiaries that are eligible

Q52: Why are the terms of the Articles

Q71: Which one of the following unsecured liabilities

Q75: Assuming the combination is accounted for as

Q78: What accounting method requires a subsidiary to

Q81: Compute consolidated equipment (net)at the date of

Q106: Norek Corp.owned 70% of the voting common