REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

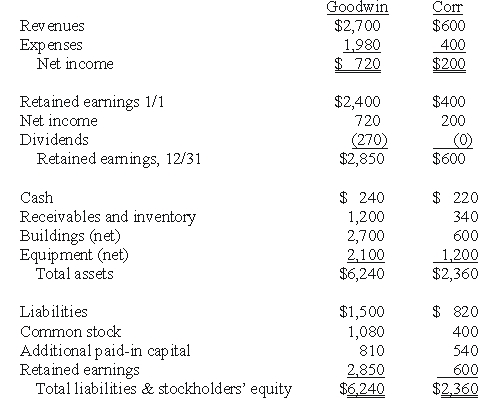

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as a purchase,compute the consolidated goodwill account at December 31,20X1.

Definitions:

Solomon Asch

A psychologist best known for his experiments in the 1950s on conformity, demonstrating the influence of group pressure on opinions.

Normative Social Influence

The influence of other people that leads us to conform in order to be liked and accepted by them.

Social Approval

The positive recognition, acceptance, or endorsement by others in a social context.

Clarify Reality

The process of making situations, expectations, or concepts more understandable and clear, often used in counseling or educational settings.

Q15: A statutory merger is a(n)<br>A)business combination in

Q33: Assume the equity method is applied.How much

Q34: Prepare the journal entry to record the

Q34: According to FASB Statement 117,how are not-for-profits

Q43: For the purpose of government-wide financial statements,the

Q63: The executor of the estate of Yelbert

Q68: Avery Company acquires Billings Company in a

Q71: Roberts retires and is paid $160,000 based

Q89: Pursley,Inc.owns 70 percent of Harry,Inc.The consolidated income

Q97: What is the total of consolidated operating