REFERENCE: Ref.02_04 on January 1,20X1,the Moody Company Entered into a Transaction for Transaction

REFERENCE: Ref.02_04

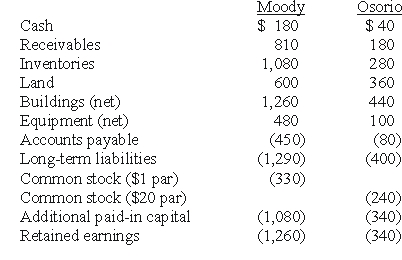

On January 1,20X1,the Moody company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this purchase.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated cash after recording the transaction.

Definitions:

Delaying Sales

A strategy where sellers postpone transactions in anticipation of better market conditions or prices.

Accelerating Expenses

Expenses that increase at a faster rate than usual, often outpacing revenue growth.

Channel Stuffing

A practice where a company inflates its sales and earnings figures by deliberately sending retailers along its distribution channel more products than they can sell to the end-user.

Earned Revenue

Income a company receives from its business activities, such as sales of goods or services, in contrast to revenue from investments or other sources.

Q17: Compute consolidated equipment at date of acquisition.<br>A)$400.<br>B)$660.<br>C)$1,060.<br>D)$1,040.<br>E)$1,050.

Q18: An acquisition transaction results in $90,000 of

Q30: What is the net effect of the

Q38: Matching<br>(1. )The schedule of liquidation<br>(2. )Deficit capital

Q44: If Watkins pays $300,000 in cash for

Q57: When should property taxes be recognized under

Q70: Which standard issued by the Governmental Accounting

Q104: Compute the December 31,2010,consolidated land.<br>A)$220,000.<br>B)$180,000.<br>C)$670,000.<br>D)$630,000.<br>E)$450,000.

Q109: Dalton Corp.owned 70% of the outstanding common

Q111: On April 7,2009,Pate Corp.sold land to Shannahan