REFERENCE: Ref.02_06

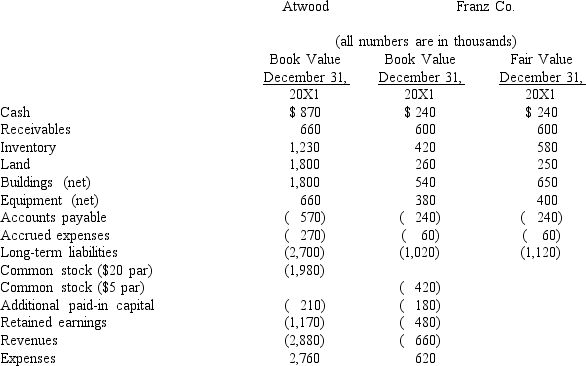

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming Atwood accounts for the combination as a purchase,compute consolidated goodwill at the date of the combination.

Definitions:

Positive Punishment

A behavior modification technique that involves adding an unpleasant consequence after an undesired behavior to decrease its occurrence.

Punishing Stimuli

Any stimulus that decreases the likelihood of the behavior that it follows, often used in the context of behavioral psychology and conditioning.

Aggressiveness

A behavior characterized by boldness or assertiveness, with a tendency to confront or attack.

Operant Conditioning

A method in which learning occurs by altering the level of a behavior through the application of reinforcers or punishments.

Q4: For an acquisition when the subsidiary retains

Q14: The gift to David is a<br>A)general legacy.<br>B)specific

Q20: On the consolidated financial statements,what amount should

Q36: Record the journal entry to record the

Q38: Compute the noncontrolling interest in Smith at

Q49: According to SFAS 160,Non-controlling Interests and Consolidated

Q52: Why are the terms of the Articles

Q56: What consolidation entry would have been recorded

Q60: Compute the noncontrolling interest in Gargiulo's net

Q108: Assume the initial value method is applied.How