Figure:

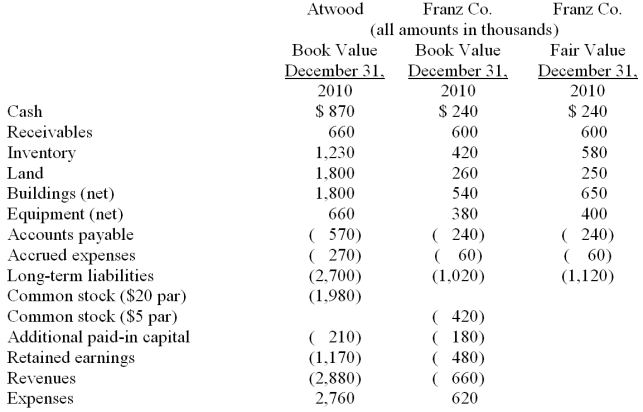

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated buildings (net) at date of acquisition.

Definitions:

Activity Cost Pool

A collection of costs assigned to specific activities based on their use of resources in a process costing system.

Factory Overhead Rate Method

This method allocates indirect manufacturing costs based on a predetermined rate to products or job orders.

Allocation Base

A measure or quantity, such as labor hours or machine hours, used to assign costs to activities or objects.

Machine Hours

A measure of the total time machines are operational within a specific period, often used in activity-based costing or allocation.

Q6: Tara Company owns 80 percent of the

Q28: What balance would Jaynes' Investment in Aaron

Q39: Which of the following production functions

Q41: Compute Pell's investment in Demers at December

Q55: What will Beatty record as its Investment

Q70: If Goehler applies the initial value method

Q75: What amount of unrealized intra-entity profit should

Q86: During 2011, Edwards Co. sold inventory to

Q87: What is the balance in Acker's Investment

Q115: Johnson, Inc. owns control over Kaspar, Inc.