REFERENCE: Ref.02_07

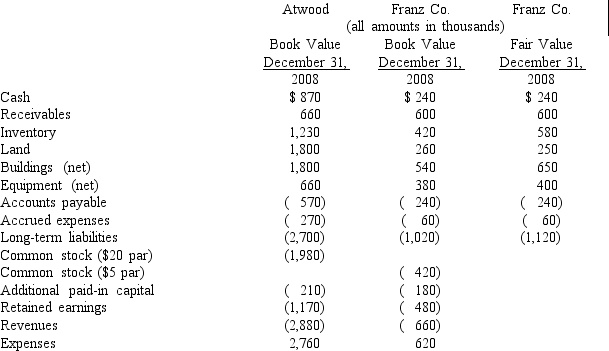

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31,2009,immediately before Atwood acquired Franz.Also included are the fair values for Franz Company's net assets at that date.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,2009.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Atwood is applying the acquisition method in accounting for Franz.To settle a difference of opinion regarding Franz's fair value,Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year.Given the probability of the required contingency payment and utilizing a 4% discount rate,the expected present value of the contingency is $5 (in thousands) .

-Compute the consolidated cash upon completion of the acquisition.

Definitions:

Thyroid Hormone

Hormones produced by the thyroid gland, including triiodothyronine (T3) and thyroxine (T4), which regulate the body's metabolism, energy production, and nervous system development.

Melanocyte-Stimulating Hormone

A hormone involved in the regulation of melanin production in the skin, affecting skin pigmentation.

Skin Pigmentation

The coloring of the skin caused by melanin production, affecting its tone and appearance.

Cortisol

A steroid hormone produced by the adrenal glands, involved in the body's response to stress and regulation of metabolism.

Q2: GASB Statement Number 33 divides all eligibility

Q10: Assumiing the combination is accounted for as

Q12: Which one of the following is a

Q30: Which of the following statements is true?<br>A)Pooling

Q30: On a statement of financial affairs,a specific

Q31: Assume there are no donor rights to

Q48: With regard to the intercompany sale,which of

Q51: What is consolidated noncurrent assets as of

Q85: Compute Parker's reported gain or loss relating

Q92: After acquiring the additional shares,what adjustment is