REFERENCE: Ref.02_08

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1,20X1.To obtain these shares,Flynn pays $400 (in thousands) and issues 10,000 shares of $20 par value common stock on this date.Flynn's stock had a fair value of $36 per share on that date.Flynn also pays $15 (in thousands) to a local investment firm for arranging the transaction.An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

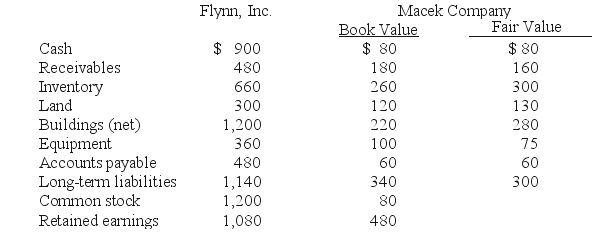

The book values for both Flynn and Macek as of January 1,20X1 follow.The fair value of each of Flynn and Macek accounts is also included.In addition,Macek holds a fully amortized trademark that still retains a $40 (in thousands) value.The figures below are in thousands.Any related question also is in thousands.

SHAPE \* MERGEFORMAT

-What amount will be reported for consolidated inventory?

Definitions:

Standards of Excellence

Benchmarks or criteria set to measure the quality and performance of products, services, or organizational behaviors.

Compelling Purpose

A strong, inspiring goal or mission that drives individuals and organizations to achieve high levels of commitment and performance.

Teamwork

Collaborative effort of a group to achieve a common goal or to complete a task in the most effective and efficient way.

Lateral Decision Making

A collaborative approach to decision-making that involves peers at the same hierarchical level, promoting inclusivity and collective intelligence.

Q2: Prince Corp.owned 80% of Kile Corp.'s common

Q9: Required:<br>Prepare a schedule to show Kurton's share

Q15: What is the adjusted book value of

Q33: What should Dura Foundation report as program

Q69: Strayten Corp.is a wholly owned subsidiary of

Q70: If Watkins issued common stock valued at

Q76: How is the gain on an intercompany

Q78: The partnership contract for Hanes and Jones

Q94: What is the impact on the noncontrolling

Q104: Which of the following statements is false