REFERENCE: Ref.02_06

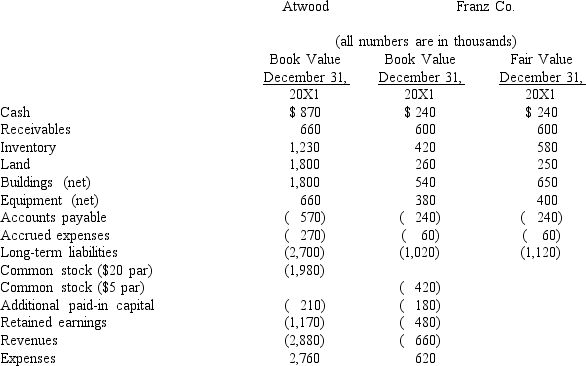

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming Atwood accounts for the combination as an acquisition,compute the investment to be recorded at date of acquisition.

Definitions:

Bribery and Fraud

Illegal practices involving the offering, giving, receiving, or soliciting of something of value for the purpose of influencing the actions of an individual in a position of trust.

Government Positions

Roles or jobs within the structure of government, ranging from elected officials to public service employees, responsible for governing and administering public policy.

Bailey v. Drexel Furniture Company

A 1922 United States Supreme Court decision that ruled the Child Labor Tax Law of 1919 unconstitutional, which had imposed a tax on companies using child labor.

Child Labor

The employment of children in any work that deprives them of their childhood, interferes with their ability to attend regular school, and that is mentally, physically, socially or morally dangerous and harmful.

Q2: What is the total amount of goodwill

Q33: What is the role of the accountant

Q33: What should Dura Foundation report as program

Q36: Which group of financial statements is prepared

Q40: King Corp.owns 85% of James Co.King uses

Q44: Compute the consolidated additional paid-in capital at

Q51: Compute the noncontrolling interest in Gargiulo's net

Q52: On July 12,2008,Fred City ordered a new

Q61: Describe the accounting for direct costs,indirect costs,and

Q106: If push-down accounting is not used,what amounts