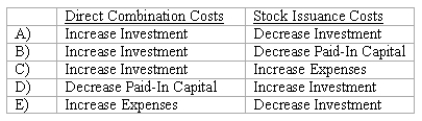

Direct combination costs and stock issuance costs are often incurred in the process of making a controlling investment in another company.How should those costs be accounted for in an Acquisition transaction?

I can't edit picture.Need to change item D so first text box is "Increase Expenses" and second text box is "Decrease Paid-In Capital"

Definitions:

Shareholder Meetings

Shareholder meetings are gatherings held by corporations where shareholders convene to discuss company affairs, make decisions, and vote on corporate matters.

Board of Directors

A body of persons chosen by stockholders to supervise and make critical decisions concerning the company's administration.

Shareholders

Individuals or entities that own shares in a corporation, giving them rights to dividends and a say in corporate affairs.

Board of Directors

A group of individuals elected to represent shareholders and make governing decisions on behalf of a corporation.

Q7: When using the acquisition method for accounting

Q25: What amount will be reported for consolidated

Q27: Direct combination costs and stock issuance costs

Q29: When comparing the difference between an upstream

Q34: Assuming that a consolidated income tax return

Q44: GASB No.34 makes which of the following

Q49: Lisa Co.paid cash for all of the

Q52: What financial statements would normally be prepared

Q73: A local partnership was considering the possibility

Q77: Compute the consolidated cash upon completion of