REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

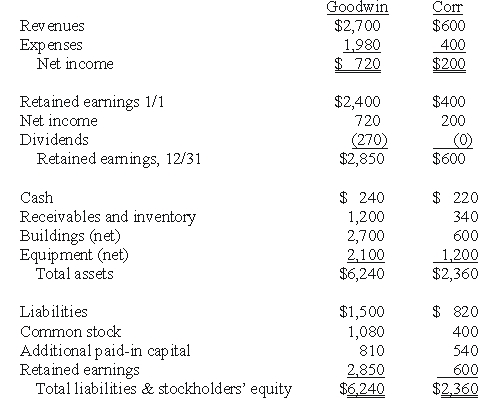

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as a purchase,compute the consolidated expenses for 20X1.

Definitions:

Posteriorly

Relating to or located toward the back or rear of an organism or structure.

Cranial Nerves

Twelve pairs of nerves that arise directly from the brain, not from the spinal cord, and pass through various foramina in the skull to innervate structures in the head, neck, and some other areas.

Ventral View

Relating to the front or anterior of any structure; viewing something from the front side.

Midbrain

A portion of the brainstem that plays an important role in vision, hearing, motor control, sleep/wake, arousal (alertness), and temperature regulation.

Q1: The 2009 total amortization of allocations is

Q8: Compute the consideration transferred in excess of

Q8: Compute the amount of consolidated equipment at

Q33: What is the amount of the personal

Q38: Which one of the following accounts would

Q50: MacHeath Inc.bought 60% of the outstanding common

Q50: Jones,Marge,and Tate LLP decided to dissolve and

Q62: When a person dies without leaving a

Q81: What is Beta's accrual-based income for 2009?<br>A)$200,000.<br>B)$276,800.<br>C)$280,000.<br>D)$296,000.<br>E)$300,000.

Q103: In Cale's accounting records,what amount would appear