Figure:

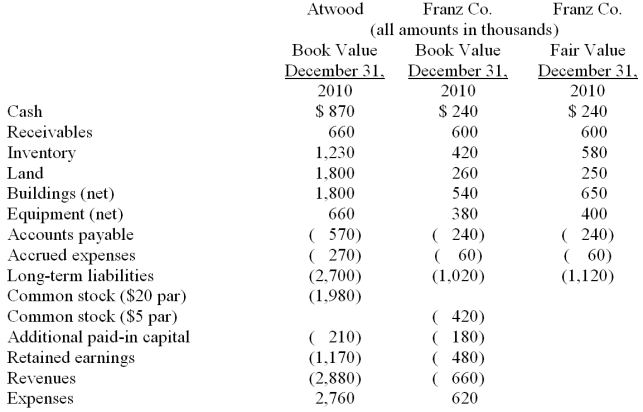

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated inventory at date of acquisition.

Definitions:

Closing Entries

Journal entries made at the end of an accounting period to transfer the balances from temporary accounts to permanent ones, preparing the books for the next period.

End-of-Period Spreadsheet

A tool, typically in spreadsheet format, used at the end of an accounting period to compile adjustments and prepare financial statements.

Adjusted Trial Balance

A list of all the accounts and their balances after adjusting entries have been made, used to prepare financial statements.

Closing Entries

Journal entries made at the end of an accounting period to transfer the balances of temporary accounts to permanent ones, thereby preparing the temporary accounts for the next accounting period.

Q2: GASB Statement Number 33 divides all eligibility

Q10: Xygote,Yen,and Zen were partners who were liquidating

Q24: Compute the amount of consolidated land at

Q29: If a subsidiary reacquires its outstanding shares

Q37: Assuming Rhine generates cash flow from operations

Q43: Anne retires and is paid $80,000 based

Q52: .The City of Wetteville has a fiscal

Q54: What are consolidated sales and cost of

Q63: When a city received a private donation

Q80: On January 1,2009,Rand Corp.issued shares of its