Essay

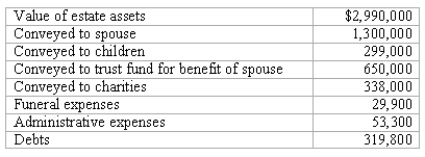

The estate of Kent Talbert reported the following information:

Required:

What would be the taxable estate value?

Definitions:

Related Questions

Q4: Jell and Dell were partners with capital

Q19: Cash of $195,000 was conveyed to the

Q25: On a statement of functional expenses for

Q36: In accounting for an acquisition using the

Q38: All of the following statements regarding the

Q40: For a partnership,how should liquidation gains and

Q41: Which of the following is not subtracted

Q59: Which one of the following requires the

Q66: One company acquires another company in a

Q83: Assuming the combination is accounted for as