The Abrams,Bartle,and Creighton Partnership Began the Process of Liquidation with the Following

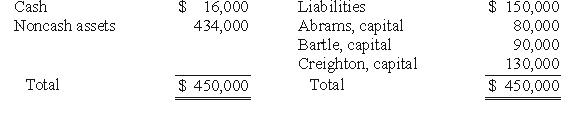

The Abrams,Bartle,and Creighton partnership began the process of liquidation with the following balance sheet:

Abrams,Bartle,and Creighton share profits and losses in a ratio of 3:2:5.Liquidation expenses are expected to be $12,000.

If the noncash assets were sold for $234,000,what amount of the loss would have been allocated to Bartle?

Definitions:

Financial Statements

Financial reports that summarize the effects of events on a business.

Horizontal Analysis

Financial analysis that compares an item in a current statement with the same item in prior statements in terms of the amount and percentage of change.

Base Year

A specific year chosen as a point of comparison for financial or economic data over time.

Current Position Analysis

The evaluation of a company’s ability to pay its current liabilities.

Q15: Assume the functional currency is the U.S.dollar,compute

Q23: Which entry would be the correct entry

Q27: The income reported by Dodge for 2007

Q30: How does a not-for-profit organization record the

Q33: If the transaction is accounted for as

Q51: Required:<br>Assume that Boerkian was a foreign subsidiary

Q62: Assume Riley issues 70,000 shares instead of

Q72: How is the fair value allocation of

Q73: What figure would have been reported for

Q91: Assuming the combination is accounted for as