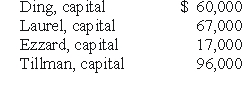

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was insolvent.Capital balances at that time were as follows.Profits and losses were divided on a 4:2:2:2 basis,respectively.

Ding's creditors filed a $25,000 claim against the partnership's assets.At that time,the partnership held assets reported at $360,000 and liabilities of $120,000.

If the assets could be sold for $228,000,what is the minimum amount that Ezzard's creditors would have received?

Definitions:

Legal Obligation

A duty enforced by law, requiring an entity or individual to perform or refrain from performing a certain action.

Date of Record

The date set by a corporation upon which the shareholders must be registered to be eligible to receive dividends or participate in corporate voting.

Common Stock

A type of equity security that represents ownership in a corporation, with holders having a claim on part of the company's assets and earnings.

Paid-In Capital

The amount of money that shareholders have invested in the company through the purchase of its stock, above the par value of the shares.

Q1: For each of the following situations,select the

Q6: How does a voluntary health and welfare

Q11: What is the purpose of Chapter 7

Q13: What is the new total balance of

Q24: Total free assets,before deducting liabilities with priority,are

Q38: What is private placement of securities?<br>A)a procedure

Q39: The SEC has usually restricted its role

Q45: What are some of the common elements

Q73: Compute the consolidated equipment (net)account at December

Q85: What amount of equity income should Deuce