REFERENCE: Ref.15_02

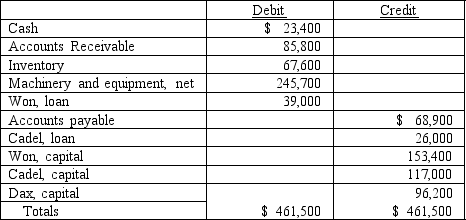

On January 1,2009,the partners of Won,Cadel,and Dax (who shared profits and losses in the ratio of 5:3:2,respectively)decided to liquidate their partnership.The trial balance at this date was as follows:

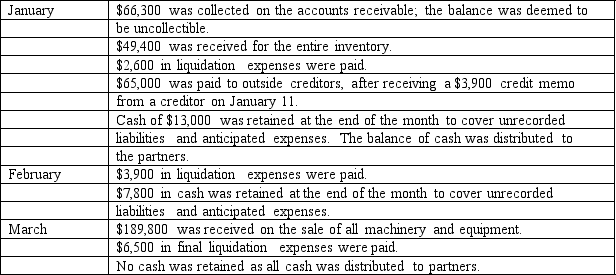

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses.All available cash,less an amount retained to provide for future expenses,was to be distributed to the partners at the end of each month.A summary of liquidation transactions follows:

-Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of March.

Definitions:

GAAP

Generally Accepted Accounting Principles, a collection of commonly-followed accounting rules and standards for financial reporting.

CVP Analysis

A management accounting method used to analyze the impact of varying levels of costs and volume on operating profit.

Fixed Cost

Expenses that do not change with the volume of production or sales, such as rent, salaries, and insurance premiums.

Activity Level

The activity level is a measure of volume of work or operations, which could influence costs and operational efficiency within a business.

Q2: A local partnership was considering the possibility

Q3: Candice Company is currently going through bankruptcy

Q9: The estate of Bobbi Jones has the

Q28: Under the temporal method,common stock would be

Q31: Assume there are no donor rights to

Q54: How are direct combination costs accounted for

Q62: If a foreign currency is the functional

Q64: A wrap-around filing<br>A)may be used by large

Q69: In settling an estate,what is the meaning

Q89: What is the Equity in Howell Income