REFERENCE: Ref.13_07 Mount Inc.was a Hardware Store That Operated in Boise,Idaho.Management Made

REFERENCE: Ref.13_07

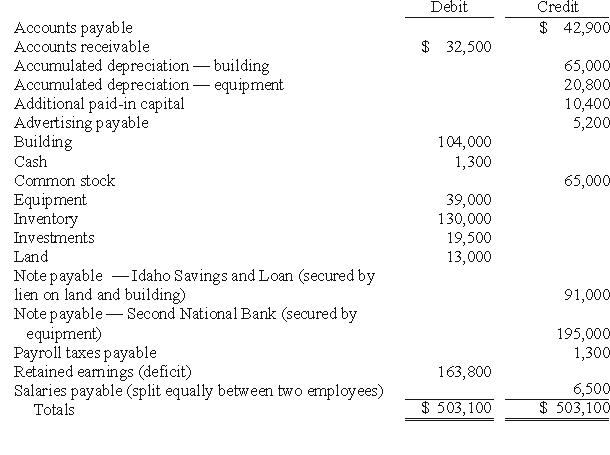

Mount Inc.was a hardware store that operated in Boise,Idaho.Management made some poor inventory acquisitions that loaded the store with unsalable merchandise.Due to the decline in revenues,the company became insolvent.Following is a trial balance as of March 15,2009,the day the company filed for a Chapter 7 liquidation.  Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated.The building and land had a fair value of $97,500,while the equipment was worth $24,700.The investments represented shares of a nationally traded company that could be sold at the time for $27,300.The entire inventory could be sold for only $42,900.Administrative expenses necessary to carry out a liquidation would have approximated $20,800.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated.The building and land had a fair value of $97,500,while the equipment was worth $24,700.The investments represented shares of a nationally traded company that could be sold at the time for $27,300.The entire inventory could be sold for only $42,900.Administrative expenses necessary to carry out a liquidation would have approximated $20,800.

-Assume that the company was being liquidated and that the following transactions occurred:

Accounts receivable of $23,400 were collected.

All of the company's inventory was sold for $52,000.

Additional accounts payable of $13,000 incurred for various expenses such as utilities and maintenance were discovered.

The land and building were sold for $92,300.

The note payable due to the Idaho Savings and Loan was paid.

The equipment was sold at auction for only $14,300 with the proceeds applied to the note owed to the Second National Bank.

The investments were sold for $27,300.

Administrative expenses totaled $26,000 as of July 26,2009,but no payment had yet been made.

Required:

Prepare a statement of realization and liquidation for the period from March 15 through July 26,2009 .

Definitions:

Non-Eligible Dividends

Dividends that do not qualify for the enhanced dividend tax credit in certain jurisdictions, often associated with smaller businesses.

Average Tax Rate

The proportion of total income that an individual or corporation pays in taxes, calculated by dividing the total tax by the taxable income.

Interest Income

The revenue earned from deposit accounts or investments through the interest payments received.

Q2: The provisions of a will currently undergoing

Q6: Under what circumstances does a partner's balance

Q18: Under the temporal method,depreciation expense would be

Q18: What is the IOSCO?

Q42: An upstream sale of inventory is a

Q44: A Chapter 7 bankruptcy is a(n)<br>A)Involuntary reorganization.<br>B)bankruptcy

Q44: What exchange rate should be used to

Q56: The appropriate format of the January 31,2008

Q63: What exchange rate should have been used

Q65: What are the four levels of claims