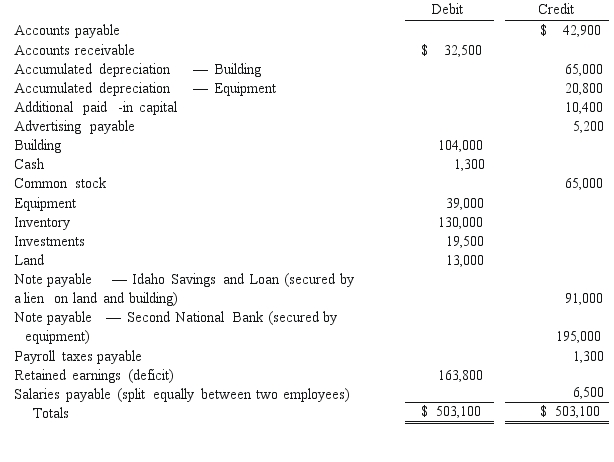

Mount Inc. was a hardware store that operated in Boise, Idaho. Management made some poor inventory acquisitions that loaded the store with unsalable merchandise. Due to the decline in revenues, the company became insolvent. Following is a trial balance as of March 15, 2018, the day the company filed forChapter 7 liquidation.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation were estimated to be $20,800.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated. The building and land had a fair value of $97,500, while the equipment was worth $24,700. The investments represented shares of a publicly traded company that could be sold at the time for $27,300. The entire inventory could be sold for only $42,900. Administrative expenses necessary to carry out a liquidation were estimated to be $20,800.

-How much cash would have been paid to an unsecured non-priority creditor who was owed a total of $1,300 by Mount Inc.? (Round the payout percentage to a whole number.)

Definitions:

Revoke Offer

To withdraw a proposal or invitation before it has been accepted, rendering it as if the offer had never been made.

Accepting Offer

is the act of agreeing to the terms of an offer, thereby creating a contract.

Coin Collection

An assortment of coins, often categorized by era, region, or special interest, that is accumulated for personal or investment purposes.

Expression Intent

The demonstration of a party's intention to undertake a particular action, often formalized through a legal or official statement.

Q6: Alternate valuation date<br>A)Begins on the day after

Q14: Sparkman Co.filed a bankruptcy petition and liquidated

Q16: What was Cleary's capital balance at the

Q21: Tony receives an automobile from his uncle,

Q36: What was the purpose of the Securities

Q65: Revenue from property taxes should be recorded

Q75: How is the disposition of the remeasurement

Q80: Which of the following results in a

Q105: The income reported by Dodge for 2008

Q113: Unreimbursed meals and entertainment paid by employees