REFERENCE: Ref.10_05

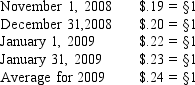

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

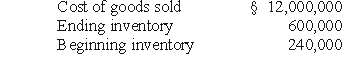

-A U.S.company's foreign subsidiary had the following amounts in stickles (§) in 2009:

The average exchange rate during 2009 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31,2009 was §1 = $.84.Assuming that the foreign country had a highly inflationary economy,at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2009 U.S.dollar income statement?

Definitions:

Purchase Discounts

Purchase discounts are reductions in price given by the supplier to the buyer for early payment or payment within a specified period.

Credit Sales

Transactions where the customer purchases goods or services on credit and pays the seller at a later date.

Bank Credit Cards

Payment cards issued by banks that allow cardholders to borrow funds within a pre-approved limit for purchases or cash advances.

Freight-In

The cost associated with transporting raw materials or goods into a facility, typically considered as part of the inventory cost.

Q3: The IASB and FASB are working on

Q9: Under modified accrual accounting,revenues should be recognized

Q14: Which of the following could be used

Q45: What is a private placement of securities?

Q58: For governmental entities,the accrual basis of accounting

Q67: In translating a foreign subsidiary's financial statements,which

Q87: Under the temporal method,retained earnings would be

Q92: How is the disposition of the translated

Q137: Erin is 67, single and has an

Q161: Arnold is single and has two children