REFERENCE: Ref.10_05

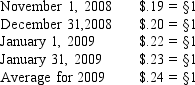

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-How is the disposition of the translated gain or loss reported on the parent company's financial statements?

Definitions:

Malpractice Lawsuits

Legal claims made against professionals who fail to perform their duties with the competence expected, leading to harm.

Missed Deadlines

Failure to complete or submit work, documents, or applications within the specified timeframe, which can have legal or procedural implications.

Breach

To violate a legal duty by an act or a failure to act.

Client Confidentiality

The ethical obligation of professionals, especially in legal and medical fields, to keep information given by or about their clients secret from others.

Q9: What term is used for a bankruptcy

Q20: Why is the SEC's Rule 14c-3 important

Q30: Which of the following results in an

Q33: What are the topics covered under the

Q37: Ted purchases some forest land in 2016

Q42: Gongman Corp.owned the following assets when it

Q61: Compute the amount of the patent reported

Q65: On June 10, 2017, Wilhelm receives a

Q92: In each of the following independent cases

Q135: Self-employed salesman spends $200 on meals while