REFERENCE: Ref.10_05

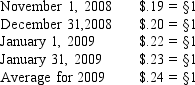

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-Under the current rate method,depreciation expense would be restated at what rate?

Definitions:

Compounded Semi-Annually

A frequency of interest calculation where the interest is added to the principal every six months, resulting in earning interest on interest in the second half of the year.

Present Value

The current value of a future sum of money or stream of cash flows, given a specified rate of return.

Perpetuity

A type of financial instrument that pays a fixed amount of cash flows indefinitely, without a maturity date.

Compounded Monthly

A method of calculating interest in which the interest earned each month is added to the principal, and future interest is calculated on the new total.

Q9: What term is used for a bankruptcy

Q21: Property taxes of 1,500,000 are levied for

Q24: What is shelf registration?

Q35: What was Young's share of income or

Q36: What information is required in the financial

Q50: The equity in income of Sacco for

Q53: Assume (1)that Boerkian was a foreign subsidiary

Q57: Which statement is false regarding the acceptance

Q59: Which one of the following requires the

Q108: Dwight owns an apartment complex that has