REFERENCE: Ref.10_12

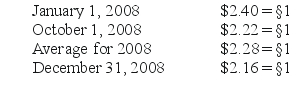

Ginvold Co.began operating a subsidiary in a foreign country on January 1,2008 by acquiring all of the common stock for §50,000.This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1,2008.A building was then purchased for §170,000.This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method.The building was immediately rented for three years to a group of local doctors for §6,000 per month.By year-end,payments totaling §60,000 had been made.On October 1,§5,000 were paid for a repair made on that date.A cash dividend of §6,000 was transferred back to Ginvold on December 31,2008.The functional currency for the subsidiary was the stickle.Currency exchange rates were as follows:

SHAPE \* MERGEFORMAT

-Prepare a balance sheet for this subsidiary in stickles and then translate these amounts into U.S.dollars.

Definitions:

Dependent Variable

A variable in an experiment or model that is expected to change in response to manipulations of the independent variable(s).

Independent Variable

A variable in an experiment or study that is manipulated or changed by the researcher to observe its effect on the dependent variable.

Regression Equation

An equation that describes the statistical relationship between one dependent variable and one or more independent variables.

Slope

The measure of the steepness or incline of a line, representing the rate of change of the function.

Q23: Assume that the company was being liquidated

Q30: Assume that Boerkian was a foreign subsidiary

Q35: What was Young's share of income or

Q61: Carlyle purchases a new personal residence for

Q66: What are the remaining partners' capital balances

Q84: Melinda and Riley are married taxpayers. During

Q115: What is the balance in the investment

Q118: Reggie and Ramona are married and have

Q140: Which of the following properties from an

Q144: Susan is 17 and is claimed as