REFERENCE: Ref.10_02

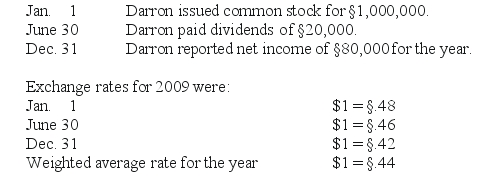

Darron Co.was formed on January 1,2009 as a wholly owned foreign subsidiary of a U.S.corporation.Darron's functional currency was the stickle (§) .The following transactions and events occurred during 2007:

SHAPE \* MERGEFORMAT

-Which of the following translation methods was originally mandated by SFAS No.8?

Definitions:

Liabilities

Financial obligations or debts that a company or individual owes to others.

GAAP

Generally Accepted Accounting Principles, a collection of commonly followed accounting rules and standards for financial reporting.

Accounting and Financial Reporting

The process of recording, summarizing, and reporting the financial transactions of a business to provide an accurate picture of its financial position and performance.

Liability

Anything owed to creditors—the claims of a company’s creditors.

Q3: A five-year lease is signed by the

Q4: Jell and Dell were partners with capital

Q10: What is the role of the trustee

Q11: The town of Wakefield opened a solid

Q24: What is shelf registration?

Q41: What is the balance in Cayman's Investment

Q58: The Albert,Boynton,and Creamer partnership was in the

Q61: Compute safe cash payments after the noncash

Q65: What was Nolan's capital balance at the

Q132: Susan is a 21 year old