REFERENCE: Ref.10_05

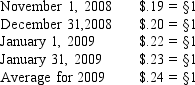

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-Under the current rate method,property,plant & equipment would be restated at what rate?

Definitions:

Q6: A historical exchange rate for a foreign

Q9: Marci is single and her adjusted

Q14: Which method of translating a foreign subsidiary's

Q16: What is the purpose of a predistribution

Q22: Which group of governmental financial statements reports

Q38: What is private placement of securities?<br>A)a procedure

Q41: What is the balance in Cayman's Investment

Q50: In 2005, Victor acquires an Andy Warhol

Q51: What was the total amount of unsecured

Q72: What is a proxy? Briefly explain the