REFERENCE: Ref.10_05

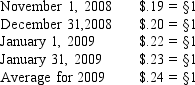

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-When consolidating a foreign subsidiary,which of the following statements is true?

Definitions:

Incremental Net Cash

The difference in net cash flows between two alternatives, emphasizing the additional cash brought in by a certain decision.

Tax Rate

The percentage at which an individual or corporation is taxed.

Incremental Net Income

The increase in net income resulting from a particular business decision or activity, compared to what it would have been without that decision or activity.

Immediate Cash Outflows

Expenses or payments that must be made in cash immediately or within a very short time frame.

Q14: Which one of the following is not

Q29: Personal property consists of any property that

Q45: Basis<br>A)Begins on the day after acquisition and

Q50: Jones,Marge,and Tate LLP decided to dissolve and

Q58: How are assets and liabilities valued on

Q61: Hilliard receives a gift of stock from

Q73: What figure would have been reported for

Q94: Which types of transactions,exchanges,or events would indicate

Q114: Orrill is single and has custody of

Q120: To be a qualifying relative, an individual