REFERENCE: Ref.10_08 Perez Company,a Mexican Subsidiary of a U.S.company,sold Equipment Costing 200,000

REFERENCE: Ref.10_08

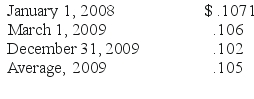

Perez Company,a Mexican subsidiary of a U.S.company,sold equipment costing 200,000 pesos with accumulated depreciation of 75,000 pesos for 140,000 pesos on March 1,2009.The equipment was purchased on January 1,2008,when the exchange rate for the peso was $.11.Relevant exchange rates for the peso are as follows:

SHAPE \* MERGEFORMAT

-The financial statements for Perez are remeasured by its U.S.parent.What amount of gain or loss would be reported in its translated income statement?

Definitions:

Beta Coefficient

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates more volatility than the market.

One-Factor APT

A model that describes financial markets and attempts to predict the returns of securities with a single factor, usually related to economic risk.

Standard Deviation

A measure of the dispersion of a set of data from its mean, indicating volatility.

Factor Portfolio

A portfolio constructed to have a specific sensitivity to certain underlying factors that are expected to influence returns, such as size, value, or momentum.

Q10: What is the role of the trustee

Q22: The Henry,Isaac,and Jacobs partnership was about to

Q25: Which of the following statements is false

Q26: What international organization currently promulgates IFRSs?<br>A)IASB.<br>B)IASC.<br>C)IOSCO.<br>D)FASB.<br>E)EU.

Q37: What journal entry will be recorded in

Q40: Under the temporal method,how would cost of

Q41: How much should the mortgage holder expect

Q62: What is a wrap-around filing?

Q74: What theoretical argument could be made against

Q103: Dorchester purchased investment realty in 2001 for