REFERENCE: Ref.01_14

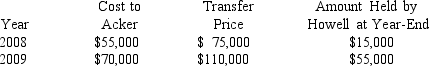

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the balance in Acker's Investment in Howell account at December 31,2008?

Definitions:

Deadweight Loss

The reduction in economic productivity that happens when a market for a product or service fails to reach or cannot reach equilibrium.

Gasoline Tax

A specific tax levied on the sale of gasoline, often implemented to fund transportation-related projects and to encourage fuel efficiency considerations among consumers.

RSV

Respiratory Syncytial Virus, a common and highly contagious virus that causes respiratory infections, particularly in children.

Bronchiolitis

An inflammatory respiratory condition often caused by a viral infection, primarily affecting the small airways (bronchioles) in the lungs, commonly seen in young children.

Q33: Rose has an adjusted gross income of

Q34: Pursley,Inc.acquires 10% of Ritz Corporation on January

Q60: The equity in income of Sacco for

Q77: Meal and entertainment expenses that are ordinary

Q81: Larry gives Linda 300 shares of stock

Q90: Which of the following translation methods was

Q91: Holding period<br>A)Begins on the day after acquisition

Q99: A passive activity<br>I.includes any trade or business

Q111: For each of the following situations, determine

Q121: Which of the following losses are generally