REFERENCE: Ref.01_14

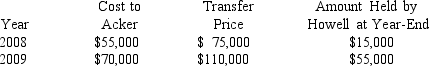

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the Equity in Howell Income that should be reported by Acker in 2009?

Definitions:

Q7: When must Form 8-K be filed with

Q21: Tony receives an automobile from his uncle,

Q22: During the year, Arlene donates stock she

Q26: Total liabilities with priority are calculated to

Q28: Under the temporal method,common stock would be

Q34: Larry is a single parent with an

Q53: Home equity loan interest<br>A)Prepaid interest.<br>B)Either a qualifying

Q61: Compute the amount of the patent reported

Q83: What is the amount of unrealized intercompany

Q103: Which of the following events is a