REFERENCE: Ref.01_14

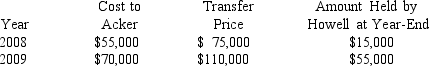

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the amount of unrealized intercompany inventory profit to be deferred on December 31,2008?

Definitions:

Express Consent

Clear and voluntary permission given by a person or party to another for a specific action or procedure, often communicated orally or in writing.

Noncompetition Provision

A clause in a contract that prohibits an individual from entering into or starting a similar profession or trade in competition against another party, typically an employer, for a certain period of time and within a specific geographic area.

Successor Company

A company or entity that takes over the operations, assets, and liabilities of another company, typically through merger or acquisition.

Assignable

Refers to a right or duty that can be transferred from one party to another.

Q9: A local partnership has assets of cash

Q24: Sullivan, a pilot for Northern Airlines, has

Q27: A taxpayer has the following income

Q30: What is required by the Trust Indenture

Q30: Which of the following results in an

Q49: For each of the following numbered situations

Q57: Sarah owns a passive activity that has

Q72: Which of the following is not a

Q74: During 2018, Marsha, a self-employed CPA,

Q107: Kristin has AGI of $120,000 in 2018