REFERENCE: Ref.01_14

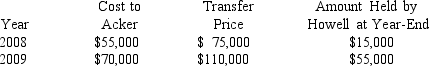

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the amount of unrealized intercompany inventory profit to be deferred on December 31,2009?

Definitions:

Critical Value Z

A threshold value on the standard normal distribution used in hypothesis testing to decide whether to reject the null hypothesis.

Test Statistic

A value calculated from sample data during a hypothesis test. It is used to decide whether to reject the null hypothesis.

Critical Value(s)

The threshold values used in hypothesis testing to determine whether to reject the null hypothesis, based on the chosen significance level.

Hypotheses

Statements made for the purpose of testing if they are true or false within the context of scientific research or experiments.

Q22: Which of the following items is not

Q46: A company has been using the equity

Q53: What was the balance in Thurman's Capital

Q54: An asset's holding period normally begins on

Q55: Describe the two parts of the SEC

Q58: Eden acquired a 20% interest in the

Q63: What information is required in proxy statements?

Q68: At-risk amount<br>A)A loss that is generally not

Q70: Norris owns a passive activity that has

Q70: The balance in the investment in Sacco