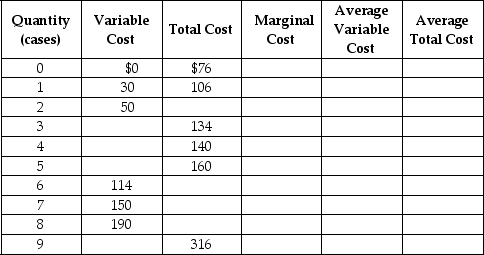

Werner & Sons is a manufacturer of three-ring binders operating in a perfectly competitive industry.Table 8-5 shows the firm's cost schedule.

Table 8-5

Use the table to answer the following questions.

a.Complete Table 8-5 by filling in the blank cells.

b.Werner is selling in a perfectly competitive market at a price of $40.What is the profit maximising or loss-minimising output?

c.Calculate the firm's profit or loss.

d.Should the firm continue to produce in the short run? Explain.

e.If the firm's fixed costs were $30 higher,what would be the profit-maximising output level in the short run? Indicate whether the output level will increase,decrease or remain unchanged compared to your answer in b.

f.Suppose fixed cost remains at $76.If the price of three-ring binders falls to $20 what is the profit-maximising or loss-minimising output?

g.Calculate the profit or loss.Should the firm continue to produce in the short run? Explain your answer.

h.Suppose the fixed cost remains at $76.What price corresponds to the shut-down point?

i.Suppose the fixed cost remains at $76.What price corresponds to the break-even point?

Definitions:

Financing Activities

Transactions and events where cash is raised for the purpose of running the business, acquiring assets, or returning value to shareholders.

Cash Flow

The net amount of cash and cash equivalents being transferred into and out of a business.

Par Value

The face value of a bond, stock, or coupon as stated by the issuer, which is the minimum amount at which the security can be sold.

Preferred Stock

A class of ownership in a corporation with a higher claim on assets and earnings than common stock, typically with dividends that are paid out before dividends to common shareholders.

Q37: In August 2008,Ethan Nicholas developed the iShoot

Q39: In reality,because few markets are perfectly competitive,some

Q56: What is the relationship among the following

Q64: Under what conditions should a competitive firm

Q97: Which of the following is true for

Q159: The demand curve for the monopoly's product

Q230: The production function shows<br>A)the total cost of

Q242: Which of the following can a firm

Q243: As a firm hires more labour in

Q286: When a firm experiences a positive technological