Use this information for Stringer Company to answer the questions that follow.

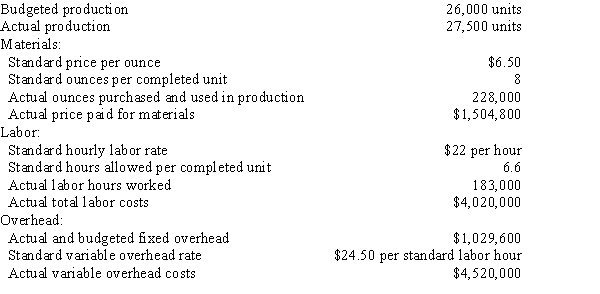

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.

-The direct materials quantity variance is

Definitions:

Salaries

Payments made to employees for their labor or services over a period.

Social Security Tax

Definition: Taxes collected by governments to fund social security programs, typically levied on both employers and employees.

Medicare Tax

A federal tax taken from earnings to fund the Medicare program, which provides health insurance for individuals aged 65 and older.

Employer Payroll Taxes

Taxes that employers are required to pay on behalf of their employees, including contributions to social security, Medicare, and unemployment taxes.

Q11: The variance from standard for factory overhead

Q49: In the short run,the selling price of

Q65: BAM Co.is evaluating a project requiring a

Q88: A favorable cost variance occurs when actual

Q89: Using the variable cost concept,determine the selling

Q98: The controllable variance measures<br>A) operating results at

Q100: If the standard to produce a given

Q100: How much service department cost will be

Q101: Make-or-buy decisions should be made only with

Q132: A cost that will not be affected