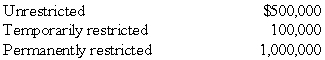

Local Services, a voluntary health and welfare organization had the following classes of net assets on July 1, 20X8, the beginning of its fiscal year:

During the year ended June 30, 20X9, the following events occurred:

(1) It purchased equipment, costing $100,000, with contributions restricted for this purpose. The contributions had been received from donors during June of 20X8.

(2) It received $130,000 of cash donations which were restricted for research activities. During the year ended June 30, 20X9, $90,000 of the contributions were expended on research.

(3) It sold investments classified in the permanently restricted class for a loss of $40,000. Dividends and interest income earned on the investments amounted to $70,000. There were no restrictions on how investment income was to be used.

(4) It received cash contributions of $200,000 from donors who did not place either time or use restrictions upon their donations.

(5) Expenses, excluding depreciation expense, for program services and supporting services incurred during the year ended June 30, 20X9, amounted to $260,000.

(6) Depreciation expense for the year ended June 30, 20X9, was $80,000.

-Refer to the above information.At June 30,20X9,the amount of permanently restricted net assets reported on the statement of financial position would be:

Definitions:

Inventory Turnover

A ratio showing how many times a company has sold and replaced inventory over a period.

Accounts Payable Turnover

A financial ratio that measures the rate at which a company pays off its suppliers by comparing net purchases to average accounts payable during a period.

Accounts Receivable Period

The Accounts Receivable Period is the average number of days it takes for a business to receive payments from its customers for goods or services sold on credit.

Accounts Receivable

Receivables from customers for goods or services provided but not yet compensated.

Q4: Parisian Co.is a French company located in

Q9: Frahm Company incurred a first quarter operating

Q16: Net income for Levin-Tom partnership for 2009

Q29: Based on the preceding information,what journal entry

Q42: Trimester Corporation's revenue for the year ended

Q51: The gain or loss on the effective

Q54: Which of the following would most likely

Q59: A pension plan that requires the employer

Q102: The entry to record accrual of employer's

Q128: On the first day of the fiscal