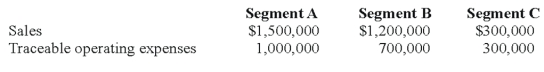

47.Lloyd Corporation reports the following information for 2008 for its three operating segments:

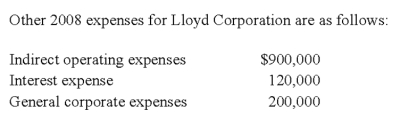

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses.Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a)Calculate the operating profit or loss for each of the segments for 2008.

b)Determine which segments are reportable,applying the operating profit or loss test.

Answer:

Answer:

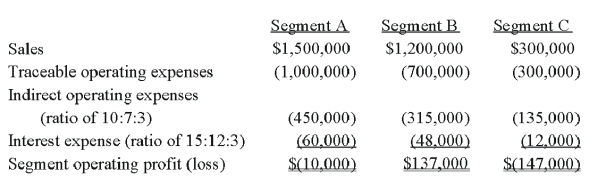

a)Operating profit or loss for each segment.

Note: General corporate expenses are not allocated for the purpose of identifying reportable segments.

b)Reportable segments.

Segments B and C both meet the operating profit or loss test.The absolute dollar amount of their respective operating profit and loss amounts are 10% or more of the absolute dollar amount of the combined segment operating losses of $157,000 ($10,000 loss + $147,000 loss).

-FASB 131 (ASC 280),Disclosure about Segments of an Enterprise and Related Information,has taken what has been referred to as a "management approach" to the definition of a segment and the allocation of costs to a segment.

Required:

a)What is meant by a management approach? How does this concept of a management approach impact the decision to disclose information?

b)How are decisions about cost allocation handled in segment disclosures?

Definitions:

Incentive Motivation

Motivation driven by the desire to gain external rewards or avoid negative outcomes.

Principal to Principal

A relationship or interaction that occurs directly between the main parties involved, without intermediaries.

Agent to Agent

Communication or interaction between autonomous entities in a network, typically in the context of software or business negotiations.

Principal to Staff

The relationship and authority dynamic between the primary leaders or executives (principals) and the employees (staff) within an organization.

Q5: Based on the preceding information,what amount will

Q33: Windsor Corporation owns 75 percent of Elven

Q34: In a private,not-for-profit hospital,which fund would record

Q41: Refer to the above information.Which statement below

Q49: The general fund of Park City acquired

Q49: Customary Review

Q50: What is the ending balance in noncontrolling

Q53: Based on the preceding information,on the statement

Q80: Based on the preceding information,at the end

Q93: Transaction: Expended 50 percent of the contributions