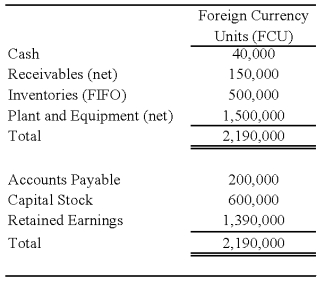

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

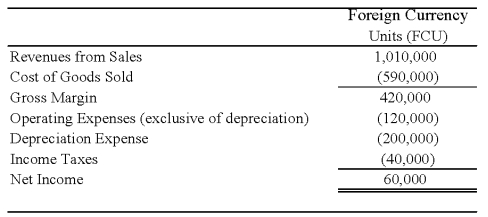

Perth's income statement for 20X8 is as follows:

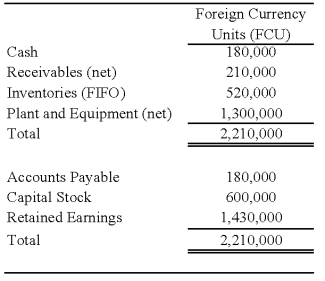

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

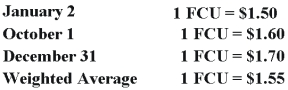

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of translation adjustments that result from translating Perth's trial balance into U.S.dollars at December 31,20X8?

Definitions:

Sewing Machine

A mechanical or electromechanical device used to stitch fabric and other materials together with thread.

Piecework

A compensation system where workers are paid based on the quantity of items they produce or complete, incentivizing higher production rates.

Michelin Company

A global company originally from France, known for its tire manufacturing, travel guides, and restaurant rating systems.

Advertisement

A public notice or announcement, often promoting a product, service, or event, aimed at attracting interest, engagement, and sales.

Q1: The term "restricted" as used in university

Q2: During the fiscal year ended June 30,20X9,the

Q10: Based on the preceding information,what was the

Q19: On January 1,20X8,Zeta Company acquired 85 percent

Q20: Based on the preceding information,what will be

Q29: A private,not-for-profit hospital received a cash contribution

Q29: Based on the information given above,what will

Q30: Based on the preceding information,what amount of

Q30: The income tax expense applicable to the

Q37: Refer to the information given.Assuming a current