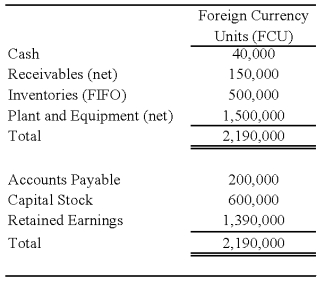

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

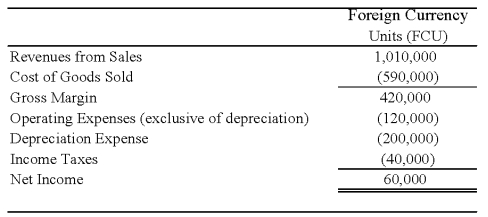

Perth's income statement for 20X8 is as follows:

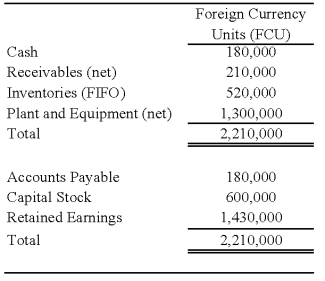

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

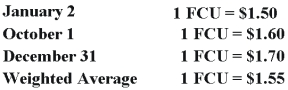

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2,20X8.Round your answer to the nearest dollar.

Definitions:

Statutory Damages

A new remedy enabling a court to award damages that it “considers just” under the circumstances, without requiring proof of damage or lost profits.

Punitive Damages

Damages in excess of the plaintiff’s actual losses, intended to punish the wrongdoer for outrageous or extreme behaviour; also known as exemplary damages.

Enhanced Injunction

A more forceful or comprehensive court order to prevent an action or to impose conditions on certain behaviors.

Damages

Monetary compensation to a victim.

Q2: Based on the information provided,what is the

Q7: Based on the preceding information,which of the

Q11: Enterprise and internal service funds should recognize

Q13: Stone Company reported $100,000,000 of revenues on

Q15: Based on the preceding information,what is the

Q20: Based on the preceding information,what amount of

Q28: Locus Corporation acquired 80 percent ownership of

Q40: RD formed a partnership on February 10,20X9.R

Q46: Based on the preceding information,which of the

Q58: Which combination of accounts and exchange rates