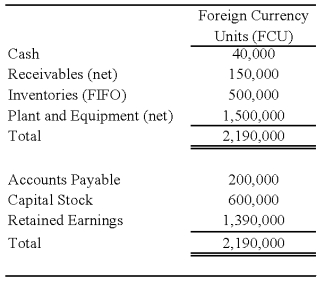

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

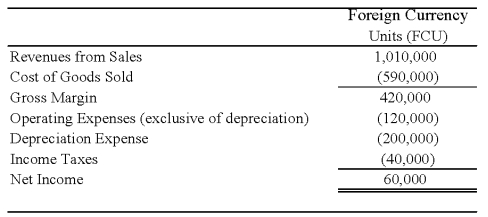

Perth's income statement for 20X8 is as follows:

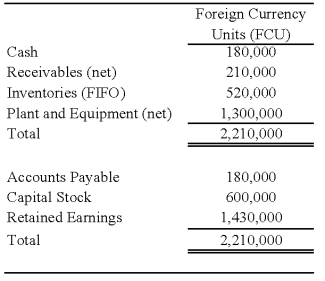

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

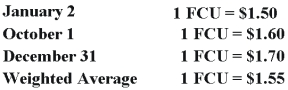

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of Perth's cost of goods sold remeasured in U.S.dollars?

Definitions:

Sanitary Landfill

A waste management site where garbage is isolated from the environment until it is safe to be integrated into the natural environment, minimizing pollution and health risks.

Standard Deviation

A statistical measure that quantifies the amount of variability or dispersion of a set of data points.

Capacity

The maximum amount of work that a system, facility, or workforce can produce or handle over a given period.

Expected Profit

The predicted amount of profit calculated by estimating revenues and subtracting estimated costs and expenses.

Q4: Based on the information provided,what is the

Q8: Based on the preceding information,which of the

Q11: Based on the information provided,what amount of

Q13: Stone Company reported $100,000,000 of revenues on

Q15: Company X denominated a December 1,20X9,purchase of

Q27: Bridger Hospital,which is operated by a religious

Q37: Based on the information given above,what amount

Q41: In order to avoid inequalities in the

Q61: Works of art and historical treasures purchased

Q69: Depreciation expense for the year was recorded.