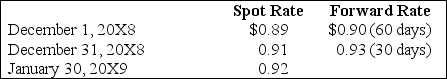

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

-Based on the preceding information,the entries on January 30,20X9,include a:

Definitions:

Firms

Business organizations that produce goods or services, often to make a profit.

Tariffs

Taxes imposed on imported goods, often to protect domestic industries or to raise government revenue.

Subsidizing Exports

Financial support provided by governments to domestic companies to lower their production costs and make their exports more competitive on the global market.

Free International Trade

The exchange of goods and services between countries without restrictive quotas, tariffs, or other barriers.

Q4: Based on the preceding information,what amount of

Q13: Based on the information provided,what amount of

Q20: Based on the information given above,what will

Q21: In which of the following situations do

Q29: Refer to the above information.Assuming Perth's local

Q34: In the absence of other evidence,common stock

Q35: According to Aristotle's principle of frequency,the ideas

Q36: René Descartes believed that:<br>A)the mind controls the

Q37: Windsor Corporation acquired 90 percent of Agro

Q41: Based on the preceding information,what amount of