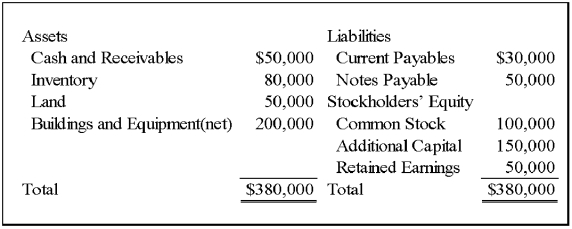

On January 1,20X9,Wilton Company acquired all of Sirius Company's common shares,for $365,000 cash.On that date,Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Wilton Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

-Based on the preceding information,what amount will be present in the revaluation capital account,when eliminating entries are prepared?

Definitions:

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including the cost of materials and labor directly tied to product creation.

Operating Activities

Transactions and events related to the core business functions, including revenue and expense activities that affect net income on the income statement.

Direct Method

A method for creating the cash flow statement by directly listing the actual cash flows associated with operating activities.

Operating Activities

Business actions that are involved in the day-to-day functions of producing goods, offering services, and other core operations.

Q4: Parisian Co.is a French company located in

Q7: The specifics of Clark Hull's equations for

Q30: Based on the preceding information,what amount of

Q34: Based on the preceding information,under the acquisition

Q40: Based on the preceding information,what amount of

Q48: Which of the following is an example

Q49: Refer to the above information.Assuming the U.S.dollar

Q51: Based on the preceding information,the entries made

Q79: Training an individual to respond differently to

Q79: Studying invertebrate nervous systems is useful because