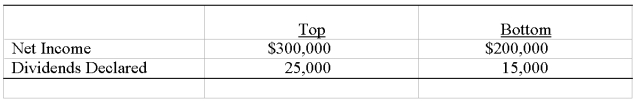

Top Company obtained 100 percent of Bottom Company's common stock on January 1,20X6 by issuing 12,500 shares of its own common stock,which had a $5 par value and a $15 fair value on that date.Bottom reported a net book value of $150,000 and its shares had a $20 per share fair value on that date.However,some of its plant assets (with a 5-year remaining life)were undervalued by $20,000 in the company's accounting records.Bottom had also developed a customer list with an estimated fair value of $10,000 and a remaining life of 10 years.Top Company uses the equity-method to account for its investment in Bottom.During 20X6 Top and Bottom reported the following:

Required:

Prepare each of the journal entries listed below related to Top's investment in Bottom.

1.Top's acquisition of Bottom.

2.Top's share of Bottom's 20X6 income.

3.Top's share of Bottom's 20X6 dividend income.

4.Top's amortization of excess acquisition price.

Definitions:

Altered Perception

A change in the way an individual senses or interprets their environment, often associated with neurological conditions or substance use.

Stable Affect

An emotional state that shows little to no change in intensity, indicating consistency in mood.

Sensory Overload

A condition where one or more of the senses experiences over-stimulation from the environment, leading to feelings of overwhelm or discomfort.

Extended Period

A lengthy duration of time beyond what is typical or expected.

Q2: Based on the preceding information,for Gamma:<br>A)no goodwill

Q8: Based on the preceding information,what amount of

Q15: Senior Inc.owns 85 percent of Junior Inc.During

Q17: Based on the preceding information,what amount of

Q17: Based on the preceding information,the translation of

Q29: Based on the preceding information,what number of

Q32: Based on the information provided,what amount will

Q43: Based on the information given above,what will

Q45: Toledo Imports,a calendar-year corporation,had the following income

Q86: Compared to rats raised in a standard